The True Cost of a Bad Sales Hire in 2026 (and How to Stop Repeating It)

Written by: Mike Carroll

You've done this before. You've invested months recruiting, weeks interviewing, and six figures onboarding a sales rep who looked perfect on paper. Three quarters later, they're gone. The pipeline is thinner. Your forecast is off. And you're back to square one.

This doesn’t make sense. You have more hiring tools than ever. Better assessments. Smarter interviews. Even AI-powered resume screening. Yet, sales hiring mistakes keep happening at the same rate they did five years ago.

Why?

Because the cost drivers of bad sales hires haven't changed.

What changed is how well those costs hide. A mis-hire today doesn't just cost you their salary. It costs you revenue you'll never recover, pipeline velocity you can't rebuild quickly, and market opportunities your competitors will claim while you're busy backfilling.

What does a bad sales hire really cost your company in 2026?

It starts at 30-150% of their base salary in direct expenses. But the real number is often 3-5x their total compensation when you account for lost deals, damaged customer relationships, team drag, and the strategic slowdown that comes from having the wrong person in a revenue-critical seat.

This post breaks down where those costs actually come from, why they're rising in 2026's hiring environment, and what you can do right now to stop repeating the same expensive cycle.

What a Bad Sales Hire Actually Costs: The Quick Answer

A bad sales hire costs far more than their salary. The total financial impact typically includes:

- Direct costs: Recruiting fees, onboarding expenses, salary and benefits during their tenure, and separation costs

- Indirect costs: Missed revenue targets, damaged pipeline, lowered team morale, and eroded customer trust

- Opportunity costs: Lost deals, slower territory growth, delayed product launches, and competitive ground given up while the seat sits empty or underperforms

These costs don't show up in a single line item. They're distributed across departments, quarters, and forecasts. By the time you add them up, the person who seemed like a manageable hiring mistake becomes a half-million-dollar problem.

If you're experiencing repeat sales hiring failures, you have a systemic breakdown in one of three areas:

- role clarity before you hire,

- screening and interviewing during the process, or

- onboarding and ramp after they start

Fixing the symptom (replacing the rep) won't solve the underlying cause.

The Direct Financial Costs of a Bad Sales Hire

Let's start with what's easiest to measure. Here's what you're actually paying for a sales hiring mistake:

|

Cost Category |

Typical Range |

What It Includes |

|

Recruiting |

$25K-$40K |

Agency fees (20-30% of base), internal recruiter time, job board spend, interview hours from hiring team |

|

Onboarding |

$15K-$30K |

Training programs, sales enablement tools, manager coaching time, lost productivity from reps training new hire |

|

Salary & Benefits |

$120K-$150K |

9-12 months of comp, benefits, and overhead for below-replacement performance |

|

Lost Ramp Time |

Variable |

6+ months paid for negative ROI in complex sales environments |

|

Total Direct Cost |

$160K-$220K |

30-150% of base salary (for a $120K role) |

Research from GoodTime shows that time-to-hire has increased in 2026, meaning you're also paying more in elapsed calendar time and extended vacancy costs while you search.

But this is where most cost analyses stop. And that's a mistake.

The Indirect Costs: Revenue, Morale, and Market Impact

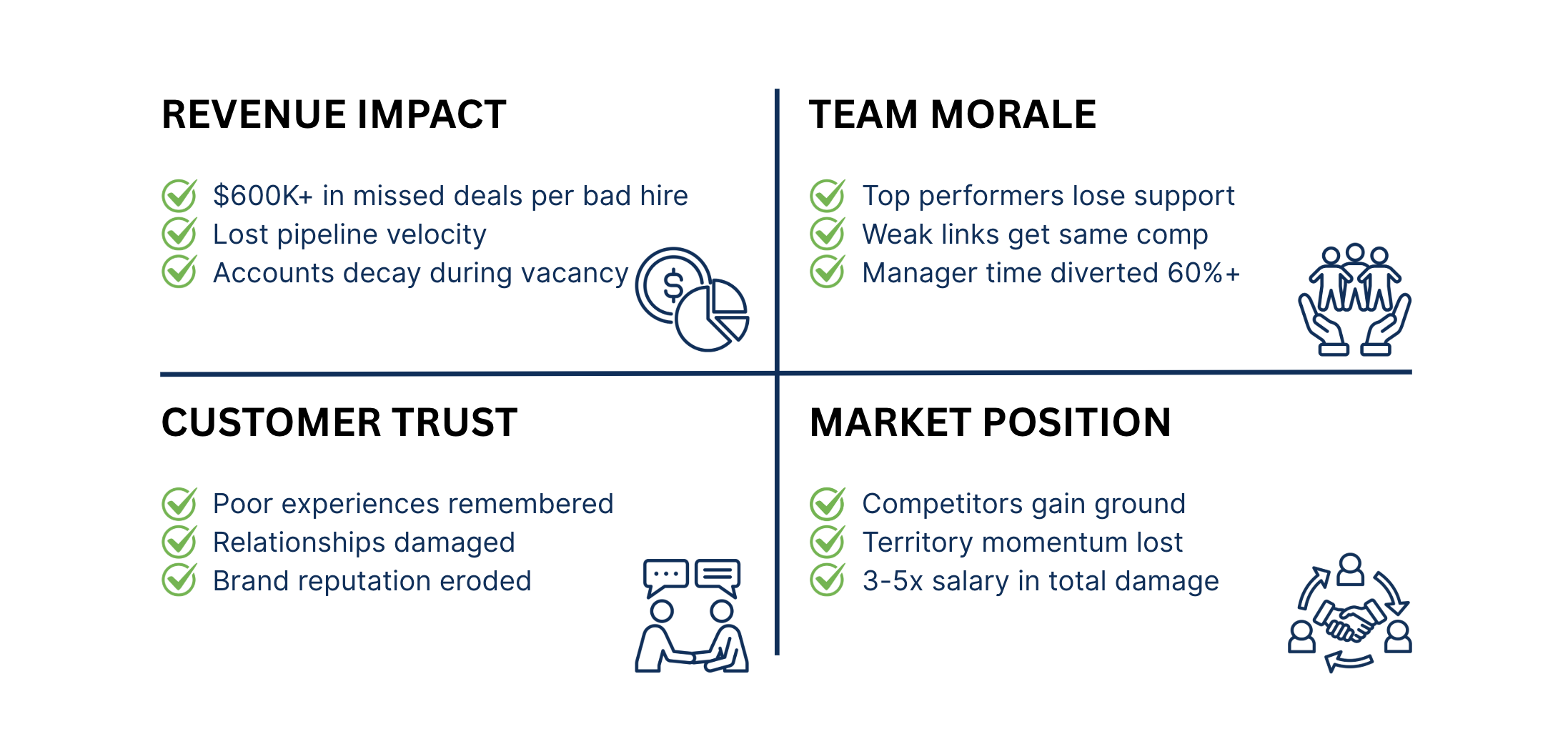

The hidden costs of a bad sales hire are where the real damage happens. These typically outweigh direct expenses by 3-5x.

Lost Revenue: The Biggest Number

If your average sales rep should produce $800K in annual revenue, and your mis-hire produces $200K, you've lost $600K in top-line revenue that year. Miss on two hires and you're down $1.2M. That's not just this year's problem. Those deals don't come back next quarter. The prospects moved on. The budget got allocated. Your competitor closed the business.

According to insights from The Sales Experts Recruitment, lost pipeline and missed opportunities typically dwarf the direct hiring costs by a factor of 3-5x. The downstream revenue impact is what turns a "bad hire" into a business problem.

Pipeline Disruption

Pipeline disruption extends beyond what one rep didn't close. When leads get assigned to someone who can't move them forward, those opportunities decay:

- Response times slip and follow-up gets missed

- Discovery calls go poorly

- Even when you reassign accounts later, the damage is done

Prospects remember the poor experience. Your brand takes a hit in that market segment.

Team Morale

Your top performers watch a struggling rep get the same leads, comp plan, and manager attention they earned through results. Resentment builds. Your sales manager spends 60% of their time coaching someone who shouldn't be there, which means your real producers get less support. Team culture shifts when accountability feels inconsistent.

Customer Trust

Customer trust erodes when a weak rep handles renewals, upsells, or key accounts. One bad interaction can undo years of relationship building. Customers don't distinguish between "the rep we just hired" and "your company." They judge you by whoever shows up on the call. The Sales Experts Recruitment research shows that customer-facing impact is one of the most underestimated costs of sales hiring mistakes.

The Real Math

When you add up these indirect costs, you start to understand why the total loss can reach 3-5x the person's compensation. The revenue never materializes. The pipeline degrades. Your team's output drops. And your customers question whether you're still the partner they signed up with.

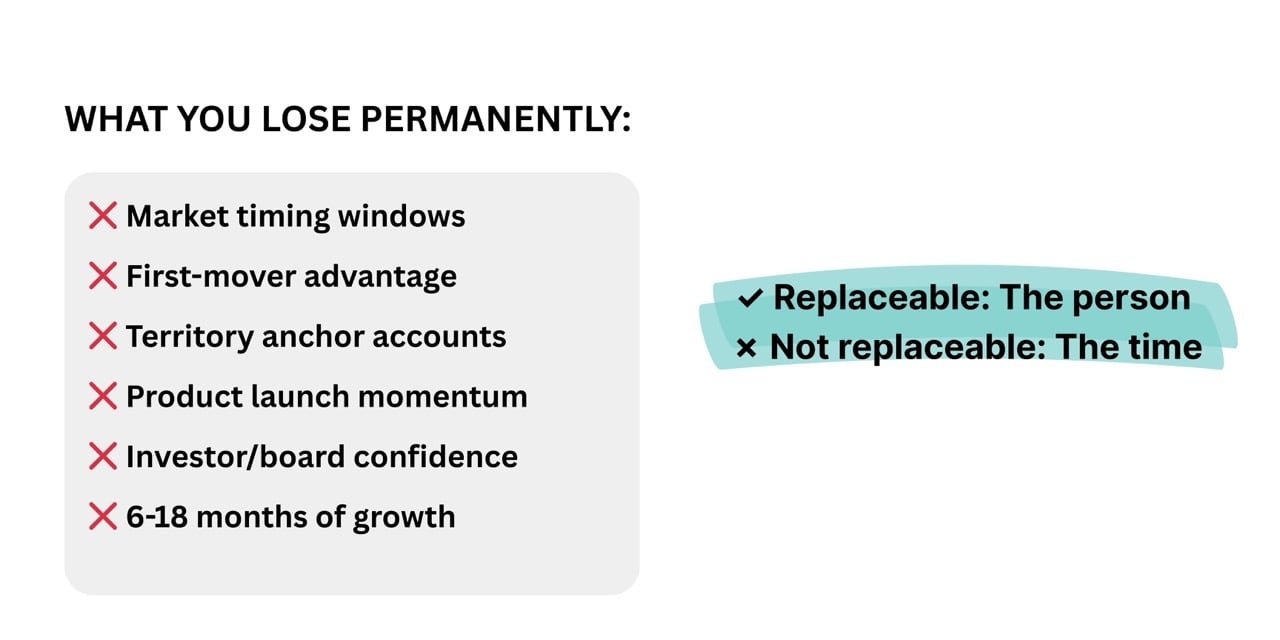

Opportunity Cost: The Growth Slowdown You Can't Get Back

Opportunity cost is what separates a hiring mistake from a strategic setback.

Every quarter a bad hire occupies a territory is a quarter your competitor is gaining ground. If you're in a land-grab market or launching a new product, that timing gap can determine whether you become the category leader or the alternative option.

Delayed Growth Initiatives

Delayed growth initiatives compound over time. If your expansion into a new vertical depends on having a capable rep in that market, and that person can't execute, you're not just behind schedule. You're losing the first-mover advantage. The accounts that would have anchored your presence there will go to whoever showed up first with a competent message.

Slowed Pipeline Velocity

Slowed pipeline velocity impacts your entire forecast model. Investors, boards, and internal planning all depend on predictable revenue growth. When one or two territories consistently underperform, your ability to forecast accurately breaks down. That uncertainty costs you:

- Credibility with stakeholders

- Optionality in strategic decisions

- Confidence in your growth projections

Market Share Erosion

Market share erosion happens silently. Your competitor doesn't need to be better than you across the board. They just need to be better in the accounts where your mis-hire is the face of your company. Over 12-18 months, those small losses add up to material market share shifts that take years to recover.

What You Can't Get Back

The strategic cost of bad sales hires is this: you lose time you can't buy back. Your product roadmap gets delayed. Your market positioning weakens. And your growth trajectory flattens while you rebuild what should have been working all along.

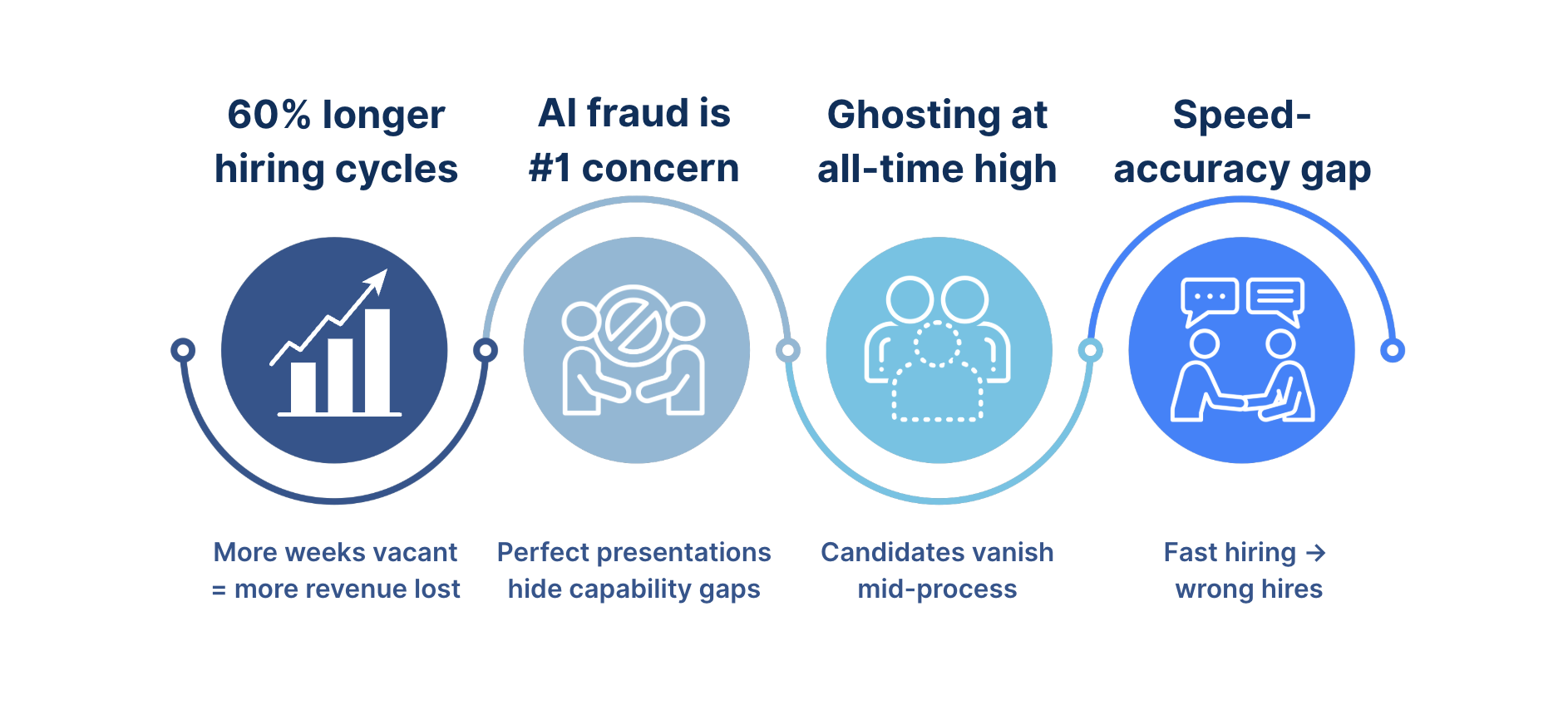

Why Sales Hiring Costs Are Rising in 2026

The 2026 hiring environment has introduced new cost drivers that make bad hires even more expensive.

Talent shortages and extended time-to-hire mean vacancies last longer.

According to GoodTime's research, organizations are experiencing longer hiring cycles as candidate selectivity increases and skills misalignment becomes more common. Every additional week a territory sits empty is lost revenue you won't recover.

AI-optimized applications have made signal detection harder, not easier.

Candidates are using AI tools to polish resumes, generate interview responses, and present qualifications that sound perfect.

The problem: Polish has gotten cheaper than capability. Separating real experience from well-crafted presentation requires more verification work than ever before.

Candidate behavior shifts have increased complexity on both sides.

Ghosting rates are rising. Candidates are more selective about where they'll accept offers. The expectations around candidate experience have elevated, meaning your hiring process needs to be faster and more engaging while also being more rigorous.

Speed vs. accuracy tradeoffs are getting harder to balance.

AI tools can accelerate parts of your process, but they don't improve accuracy. They make you faster at the steps you're already doing. If your screening criteria are wrong, AI just helps you mis-hire more efficiently.

The compounding effect: these environmental factors mean the cost of getting it wrong has gone up while the difficulty of getting it right has increased. That gap is where expensive mistakes live.

How to Reduce the Cost of Sales Hiring Mistakes

The good news: most of these costs are preventable. The pattern behind repeat hiring failures is almost always a breakdown in one of three areas. Fix the breakdown, and the costs drop.

Before You Hire: Build Clarity

Most sales hiring mistakes start before you post the job. If you don't have a clear, specific definition of what success looks like in the role, you'll hire based on gut feel and generic qualifications that don't predict performance.

Develop a job scorecard that defines exactly what the person will be measured on. Not a job description. A scorecard. This includes:

- Who they'll call on

- What your average order value is

- What your sales cycle length looks like

- How many stakeholders are typically involved

- What technical or industry depth is required

If you can't answer these questions precisely, you don't have role clarity.

Define success metrics for 30, 60, and 90 days. What does "good" look like at each milestone? If you don't know, you can't evaluate whether someone is on track. You'll wait too long to make decisions, and you'll waste months hoping things improve.

Align your hiring team on what you're actually looking for. If your sales manager, recruiter, and executive team all have different mental models of the ideal candidate, you'll end up with inconsistent interviews and conflicting feedback. That inconsistency is how average candidates slip through.

During Hiring: Improve Screening and Interviewing

This is where most companies lose the game. Interviews feel productive, but they don't reveal capability. Managers ask different questions. Decisions get made based on likability instead of evidence.

Use structured interviews that ask every candidate the same capability-revealing questions. This doesn't mean scripts. It means consistency across the topics that matter:

- How have they handled quota pressure?

- How do they approach complex stakeholder environments?

- What does their actual pipeline management look like?

Apply targeted assessments that simulate real work.

- Have them walk through a deal.

- Ask them to analyze your ICP and explain how they'd approach it.

- Give them a scenario that reveals how they think, not just how they present.

- Pre-hire assessments work when they're job-relevant and hard to fake.

Minimize bias and gut-feel decisions. Your instinct about someone after a 45-minute conversation is not predictive. What's predictive is whether they've demonstrably done the work you're hiring them to do, at the level you need, in an environment similar to yours.

After You Hire: Fix Onboarding and Ramp

Even good hires fail with bad onboarding. If you don't have a structured ramp system, you're relying on hope instead of process.

Build 30/60/90 day plans with clear milestones and expectations:

- What should they know by day 30?

- What should they be able to do by day 60?

- What does full productivity look like at 90 days?

If you haven't defined this, you simply have orientation.

Involve managers early and often. Onboarding is not HR's job. It's the sales manager's job. If your manager isn't meeting with new hires multiple times in the first two weeks, you're setting people up to guess their way through ramp.

Communicate before they start. The time between offer acceptance and day one is when new hires are most nervous and most likely to reconsider. Stay connected. Send them resources. Make them feel like they made the right choice.

Measure and Improve Continuously

The only way to reduce hiring costs over time is to measure the quality of hire and connect it back to your process.

Track quality-of-hire metrics that go beyond "did we fill the seat":

- What percentage of hires hit quota in their first year?

- How long does it take new hires to reach productivity?

- What's your voluntary vs. involuntary turnover rate for sales roles?

Tie hiring KPIs to revenue outcomes. If your recruiting team is measured on time-to-fill but not quality-of-hire, they're just optimized for speed. The best hiring systems measure both speed and results.

Before you make another hire, run the Sales Hiring Diagnostic to identify which breakdown is costing you: clarity, screening, or onboarding. Most companies assume they know where the problem is. The data usually tells a different story.

Frequently Asked Questions

How much does a bad sales hire cost a company in 2026?

The direct costs alone typically range from 30-150% of the person's base salary, covering recruiting, onboarding, compensation, and separation expenses. But total costs often reach 3-5x their total compensation when you include lost revenue, damaged pipeline, team productivity drag, and opportunity cost. Research from Barracuda Staffing & Consulting shows some organizations report losses exceeding $1 million per failed sales hire when all factors are included.

What are the biggest hidden costs of a bad sales hire?

The costs that don't show up in HR reports are usually the most expensive: missed revenue from deals that never close, pipeline degradation from poor account management, reduced team morale that lowers everyone's performance, damaged customer relationships that take years to rebuild, and strategic opportunity cost from delayed growth initiatives. These indirect costs typically outweigh direct expenses by 3-5x.

Why are sales hiring mistakes so common even in 2026?

Three main reasons: First, the complexity of modern sales roles has increased while assessment methods haven't kept pace. Second, AI tools have made it easier for candidates to present well without having real capability. Third, most companies still rely on unstructured interviews and gut-feel decisions instead of systematic evaluation. The result: polish and presentation have become cheaper than actual sales skills, making signal detection harder than ever.

How can organizations prevent the cost of bad sales hires?

Prevention comes from fixing systemic breakdowns in three areas. Before hiring, develop role clarity with specific scorecards and success criteria. During hiring, use structured interviews and job-relevant assessments that reveal capability instead of presentation skills. After hiring, implement structured onboarding with clear 30/60/90 day milestones. Most importantly, measure quality of hire and connect recruiting metrics to actual revenue outcomes, not just time-to-fill.

Does AI help reduce bad hire costs?

AI can improve process speed and administrative efficiency, but it doesn't automatically improve hiring accuracy. AI-powered resume screening can process more candidates faster, but it only works if your screening criteria are correct. If you're looking for the wrong signals, AI just helps you mis-hire more efficiently. The most effective approach: use AI to handle speed and scale, but keep human judgment in capability evaluation. Structured systems outperform both gut-feel decisions and fully automated screening.

Stop Paying the Same Price Twice

The real cost of a bad sales hire in 2026 goes far beyond salary. It's the revenue you won't recover, the market position you'll lose, and the strategic momentum you'll never get back.

Most companies treat hiring failures as isolated mistakes. They replace the rep, adjust the comp plan, and try again. But if you're experiencing repeat failures, you have a system problem. The pattern is almost always the same: unclear role definition before you hire, inconsistent screening during the process, or weak onboarding after someone starts.

Before you make your next sales hire, take the Sales Hiring Diagnostic. It will show you exactly which part of your system is breaking down and costing you revenue. Most leaders assume they know where the problem is. The diagnostic usually reveals something different.

Related Articles:

Why Sales Hires Fail: A 2026 Diagnostic Guide for Middle-Market CEOs

Why do sales hires keep failing, even when leaders do everything “right”?

Ready to Build a High-Performing Sales Team?

Let's create your custom Sales Transformation Program.